Persuading Part of an Audience

I propose a cheap-talk model in which the sender can use private messages and only cares about persuading a subset of her audience. For example, a candidate only needs to persuade a majority of the electorate in order to win an election. I find that senders can gain credibility by speaking truthfully to some receivers while lying to others. In general settings, the model admits information transmission in equilibrium for some prior beliefs. The sender can approximate her preferred outcome when the fraction of the audience she needs to persuade is sufficiently small. I characterize the sender-optimal equilibrium and the benefit of not having to persuade your whole audience in separable environments. I also analyze different applications and verify that the results are robust to some perturbations of the model, including non-transparent motives as in Crawford and Sobel (1982), and full commitment as in Kamenica and Gentzkow (2011). .

Example — targeted poplitical campaigns

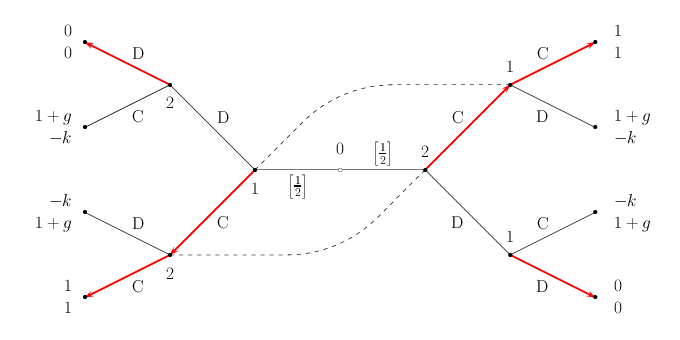

Suppose a politician a politician (she) running for office. The state of the world equals either 0 or 1. Each voter (he) will vote for the politician if and only if his expectation about the state is greater than \(1/2\). The voters’ common prior expectation about the state lies in \((1/3,1/2)\), so that nobody is willing to vote for the politician ex ante. Suppose that the politician knows the true state and can talk privately with each voter. I claim that, if there are sufficiently many voters, then there exists an equilibrium in which she wins the election for sure regardless of the state.

This is possible because the politician only needs to persuade half plus one of the electorate in order to win the election. She can attain this goal by using the following strategy. If the state is indeed \(1\), then she will let every single voter know this fact. If the state is \(0\), then she will randomly choose half plus one of the voters and tell them that the state is \(1\), despite the fact that it is not.

A voter that receives a message saying that the state equals \(1\) knows that this could be a lie. However, he also knows that he would be more likely to receive this message if it was actually true. Hence, the message conveys some information. When the population is large enough, it conveys sufficient information to overturn prior beliefs arbitrarily close to \(1/3\). In that case, every voter who receives this message prefers to vote for the politician.

In the paper studies a general cheap-talk model in which an informed sender can engage in private conversation with many receivers and cares about the behavior of some but not all of them. My main finding is that having to persuade only part of an audience significantly facilitates information transmission and increases persuasion power.